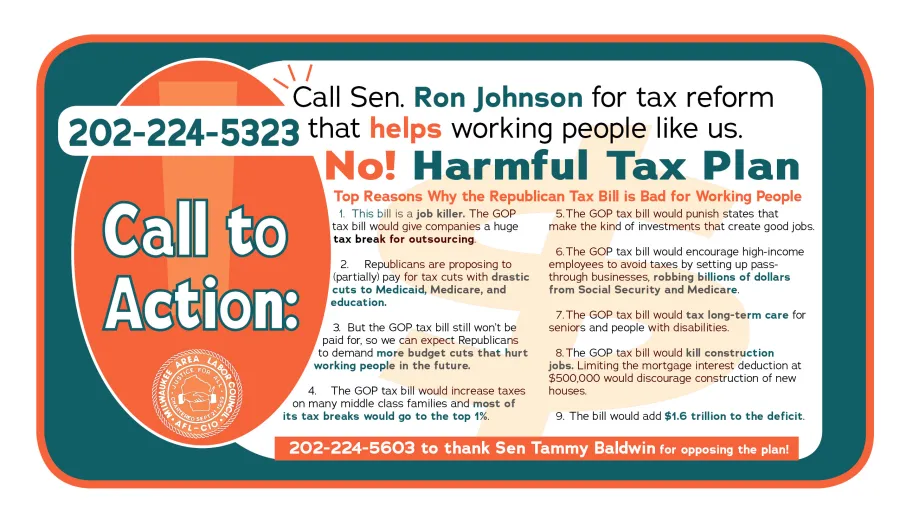

Call Your Senators: Tax Reform that Benefits the Middle Class

Call to Action: Please call your Senators to be heard.

The tax plan will add $1.6 trillion to the deficit. Ron Johnson’s number in DC: 202-224-5323. Give his office a call to let him know you want tax reform that helps working people like you and me, and middle class families.

Call 202-224-5603 to thank Sen. Tammy Baldwin for opposing this bill.

The Ways & Means Committee considers the Tax Proposal bill on Monday, November 6. We expect leadership to attempt a vote on the floor the week of Monday, November 13. Our best intel is that the senate will introduce their own version of the bill in the next couple of weeks. We expect there will be substantial differences within and between the House and Senate Republican caucuses.

President Trumka issued this statement in response to the introduction of the bill:

This tax bill is a job killer. It gives hundreds of billions of dollars in tax breaks to companies that outsource jobs and profits. No matter how it’s spun by Republican politicians, their tax bill is nothing but giveaways to Wall Street, big corporations and millionaires, paid for on the backs of working families.

It is astounding that a tax bill that will encourage offshoring is even under consideration. It’s shameless to propose cutting Medicaid, Medicare, education and infrastructure to pay for tax breaks for the 1%. History tells us, commonsense tells us and careful analysis of this tax bill tells us that these tax giveaways for the wealthy and big corporations will never trickle down to the rest of us. Real tax reform actually can put money back in the pockets of working people, but this is not that kind of plan.